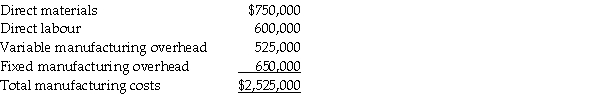

Victory Electronics makes a part used in the manufacture of desktop computers.Management is considering whether to continue manufacturing the part,or to buy the part from an outside source at a cost of $27.00 per part.Victory Electronics needs 80,000 parts per year.The cost of manufacturing 80,000 parts is computed as follows:

If Victory Electronics buys the part,it would pay $.40 per unit to transport the parts to its manufacturing plant.Purchasing the part from an outside source would enable the company to avoid 40% of fixed manufacturing overhead costs.Victory Electronics's factory space freed up by purchasing the part from an outside supplier could be used to manufacture another product with a contribution margin of $65,000.

Prepare an analysis to show which alternative makes the best use of Victory Electronics's factory space:

1.Make the part.

2.Buy the part and leave facilities idle.

3.Buy the part and use facilities to make another product.

Definitions:

Robinson-Patman Act

A United States federal law aimed at preventing unfair competition and price discrimination by regulating trade practices.

Advertising Act

Legislation that regulates advertising practices to protect consumers from misleading or harmful advertisements.

Profit Maximization

A business strategy aimed at achieving the highest possible profit within a given period, usually through the optimization of sales and production costs.

Pricing Objective

The goals that a company aims to achieve through its pricing strategy, such as maximizing profits, increasing market share, or discouraging competition.

Q12: CVP stands for Cost-Volume-Profit.

Q31: On a CVP graph,the intersection of the

Q33: To find the break-even point using the

Q61: Checkerbox Company has a predicted operating income

Q90: Which of the following budgets is not

Q122: A company's plan for purchases of property,plant,equipment,and

Q148: Which of the following is irrelevant when

Q152: Copper Company reports the following standards for

Q192: Webber Company is preparing its cash budget

Q220: Tuff Stuff Company's managers received the following