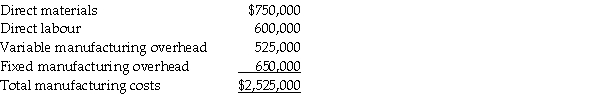

Victory Electronics makes a part used in the manufacture of desktop computers.Management is considering whether to continue manufacturing the part,or to buy the part from an outside source at a cost of $27.00 per part.Victory Electronics needs 80,000 parts per year.The cost of manufacturing 80,000 parts is computed as follows:

If Victory Electronics buys the part,it would pay $.40 per unit to transport the parts to its manufacturing plant.Purchasing the part from an outside source would enable the company to avoid 40% of fixed manufacturing overhead costs.Victory Electronics's factory space freed up by purchasing the part from an outside supplier could be used to manufacture another product with a contribution margin of $65,000.

Prepare an analysis to show which alternative makes the best use of Victory Electronics's factory space:

1.Make the part.

2.Buy the part and leave facilities idle.

3.Buy the part and use facilities to make another product.

Definitions:

Michelin Tire Company

A multinational tire manufacturer based in France known for its tire quality, safety innovations, and the Michelin Guide, which awards Michelin stars for excellence to a select few establishments.

B2B Markets

Business-to-Business markets where transactions are conducted between companies rather than between companies and individual consumers.

Modified Rebuy

is a buying situation where an organization makes some changes to their regular purchase specifications or suppliers, requiring some review but not starting from scratch.

Current Vendors

Businesses or suppliers currently providing products or services to a company.

Q16: Good Looks Fitness operates a large fitness

Q77: Variable costs are relevant to a special

Q88: Thomario's Powder Coatings makes payments on its

Q91: An amusement park's games department which reports

Q102: If fixed costs remain unchanged and Champion

Q102: Samson Company currently sells its products for

Q139: The format of the "cost of goods

Q176: Darren Company is thinking of dropping product

Q193: Make or buy decisions are often referred

Q279: Using variable costing,what is the operating income