Instruction 12.22

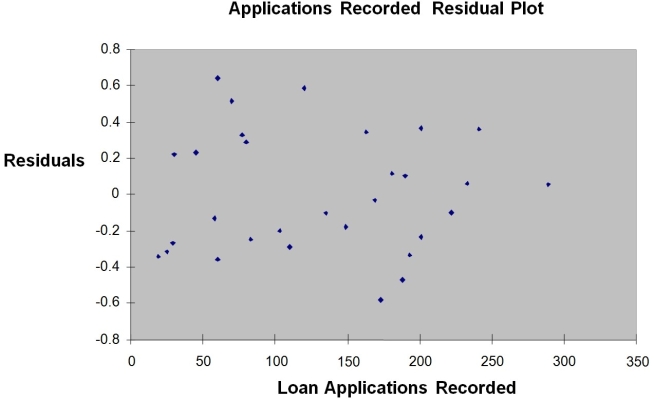

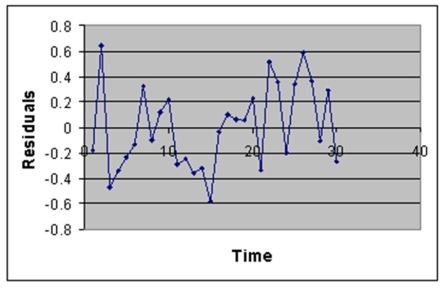

The manager of the purchasing department of a large savings and loan organization would like to develop a model to predict the amount of time (measured in hours) it takes to record a loan application. Data are collected from a sample of 30 days, and the number of applications recorded and completion time in hours is recorded. Below is the regression output:

Note: 4.3946E-15 is 4.3946 × 10-15.

-Referring to Instruction 12.22,the model appears to be adequate based on the residual analyses.

Definitions:

SUTA Tax Rate

The state unemployment tax rate, which employers must pay to fund the state's unemployment insurance program.

Unemployment Taxes

Taxes paid by employers to fund unemployment insurance programs, varying by state and based on the amount of wages paid to employees.

Federal Income Taxes

Taxes levied by the federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Withholding Allowances

Amounts exempted from an employee's income tax withholding, directly related to the number of dependents and personal situations.

Q2: Referring to Instruction 11-9,at 1% level of

Q18: The MSE must always be positive.

Q19: Referring to Instruction 13.22,the null hypothesis H<sub>0</sub>:

Q19: Referring to Instruction 10-12,what is the estimated

Q70: Referring to Instruction 12.11,the estimated mean amount

Q89: "What conclusions and interpretations can you reach

Q114: The potential for correlation within a set

Q144: Referring to Instruction 12.33,the value of the

Q169: Referring to Instruction 14-4,the number of arrivals

Q249: Referring to Instruction 13.7,the adjusted r<sup>2</sup> is_.