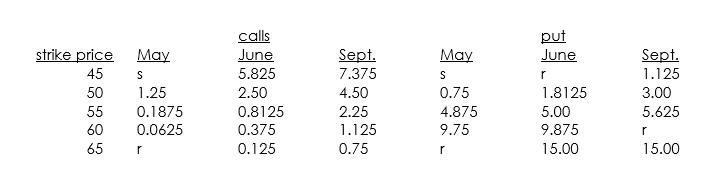

You have just learned through the grapevine that Pfizer (currently at $50.625 per share)may be a takeover candidate at $65 per share.You would like to speculate on the rumor,but you are worried that the stock will drop significantly if the rumor is false.Therefore,you have decided to use options to exploit this information.You are given the following option data for today,May 15th:

calls puts

a. Set up an option position that will best exploit the information you have, assuming that the takeover will happen by September 16 (the expiration day of the September options).

b. Assume now that the annualized standard deviation of Pfizer's stock price is 0.40 and that the six-month T-bill rate is 6%. Furthermore, assume that Pfizer pays a quarterly dividend of 50 cents and that the dividends are paid in April, July, October and January. What would your Black-Scholes estimates be for the options in the position that you have described in part a?

c. If the beta of Pfizer stock is 1.0, what is the beta of the position that you have set up in part a?

d. What are the deltas of the options that you have chosen for your position?

Definitions:

Job Enrichment

Enhancing a job by adding more meaningful tasks and duties to make the work more rewarding or satisfying.

Career Launch

The initiation phase of one's professional journey, often involving the first significant job or position in a chosen field.

No Experience

Refers to a lack of previous involvement or knowledge in a specific area or task.

Tri-Party Agreements

Tri-party agreements are contracts involving three parties, where one party agrees to fulfill a condition to the second party based on a condition enforced by the third party.

Q12: Julia earns $60,000 each year for two

Q38: Referring to Instruction 19-1,the director now wants

Q42: Referring to Instruction 17-7,what is the expected

Q47: Referring to Instruction 17-1,what is the opportunity

Q48: Referring to Instruction 16-7,what is the value

Q50: The risk-averter's curve shows a rapid increase

Q55: Two identical stones are dropped from rest

Q90: Assume that you have been asked

Q109: The fact that superior returns can not

Q116: Referring to Instruction 18-8,based on the R