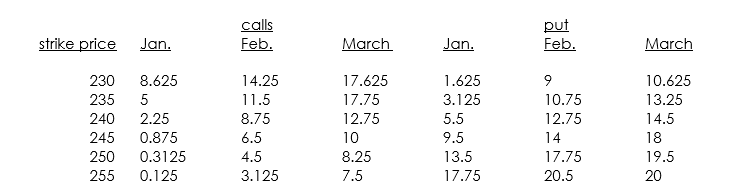

The trade deficit numbers are expected out on February 19,and you think that market will move a lot,either up or down.You want to take advantage of this using options.You are given the following stock-index option data for today,January 14 (the current level of the index is 236.99,and the annualized T-bill rate is 6%):

a. Find at least two options in the above listing that violate arbitrage

conditions.

b. How would you set up a position using February options to take advantage

of the volatility from the trade deficit numbers? (The February options expire

on the evening of February 19.)

c. What are the breakeven points for the position in part b? (You can draw a

payoff diagram if you want to.)

d. Assume no dividends are paid and that the variance in the stock index is

0.09, and use the Black-Scholes model to value the February 235 call and

the February 235 put.

Definitions:

Extreme Opening Offer

An initial proposal in negotiations that is much higher or lower than what one actually expects to achieve, used as a strategic move.

Tactical Tasks

These are specific actions or responsibilities assigned to individuals or units in a military operation, aimed at achieving a particular objective in support of an overall strategy.

Distributive Bargaining

A negotiation strategy where parties compete to divide a fixed resource, often resulting in a win-lose situation.

Convey Message

The act of communicating information, thoughts, or feelings clearly and effectively to others, often with specific intent or purpose.

Q3: C<sub>pk</sub> > 1 indicates that the process

Q12: Julia earns $60,000 each year for two

Q20: Referring to Instruction 16-6,what is the value

Q28: A box of mass m is pressed

Q32: Which of the graphs in the figure

Q61: A Ferris wheel has diameter of 10

Q62: Three objects are connected as shown in

Q64: Given 0.2,0.4,and 0.4 are the probabilities for

Q74: What is the product of 11.24 and

Q80: A 60.0-kg person rides in an elevator