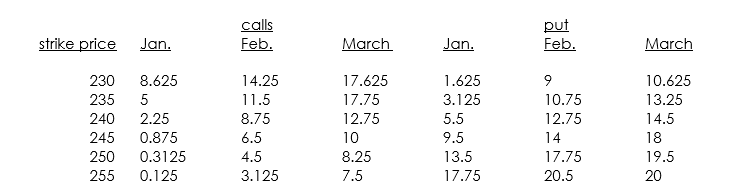

The trade deficit numbers are expected out on February 19,and you think that market will move a lot,either up or down.You want to take advantage of this using options.You are given the following stock-index option data for today,January 14 (the current level of the index is 236.99,and the annualized T-bill rate is 6%):

a. Find at least two options in the above listing that violate arbitrage

conditions.

b. How would you set up a position using February options to take advantage

of the volatility from the trade deficit numbers? (The February options expire

on the evening of February 19.)

c. What are the breakeven points for the position in part b? (You can draw a

payoff diagram if you want to.)

d. Assume no dividends are paid and that the variance in the stock index is

0.09, and use the Black-Scholes model to value the February 235 call and

the February 235 put.

Definitions:

Midpoint

The value that lies halfway between the highest and lowest values in a given set of numbers.

Interquartile Range

The range between the first and third quartiles in a data set, representing the middle 50% of values and used as a measure of variability.

Observations

Data points or recorded information obtained from experimental or study designs, representing individual examples of the variables being studied.

Median

The middle value in a list of numbers, which separates the higher half from the lower half.

Q6: Special or assignable causes of variation are

Q20: Which of the following is an accurate

Q22: The number of alternatives for the payoff

Q23: The Variance Inflationary Factor (VIF)measures the<br>A) standard

Q30: A person is dragging a packing crate

Q30: Referring to Instruction 16-6,what is the value

Q34: A car accelerates from <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6394/.jpg" alt="A

Q38: Find the net work done by friction

Q39: A wind farm generator uses a two-bladed

Q77: In addition to 1 m = 39.37