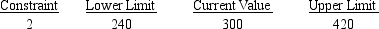

A section of output from The Management Scientist is shown here.  What will happen if the right-hand-side for constraint 2 increases by 200?

What will happen if the right-hand-side for constraint 2 increases by 200?

Definitions:

Total Risk

Represents the full spectrum of all types of risk associated with an investment, including both systematic and unsystematic risks.

Market Risk

The risk of losses in investments caused by factors that affect the entire market or economy, such as geopolitical events or changes in interest rates.

Slope of the SML

Measures the trade-off between risk and return in financial markets as depicted by the Security Market Line.

Investors' Risk Aversion

Refers to the level of reluctance exhibited by investors to engage in investments with uncertain outcomes, preferring lower risk options.

Q7: Qualitative forecasting techniques should be applied in

Q14: Write the linear program for this transshipment

Q15: The goal of portfolio models is to

Q18: It is possible to have more than

Q25: The assumption of exponentially distributed service times

Q29: Consider the following two-person zero-sum game.Assume the

Q30: Production constraints frequently take the form:<br>beginning inventory

Q43: The Decision Table tool in Crystal Ball

Q44: The cosmic background radiation corresponds to a

Q64: The detonation of a certain nuclear device