Use the following Management Scientist output to answer the questions.

MIN 4X1+5X2+6X3

S.T.

1)X1+X2+X3<85

2)3X1+4X2+2X3>280

3)2X1+4X2+4X3>320

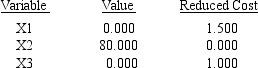

Objective Function Value = 400.000

OBJECTIVE COEFFICIENT RANGES

OBJECTIVE COEFFICIENT RANGES

RIGHT HAND SIDE RANGES

RIGHT HAND SIDE RANGES

a.What is the optimal solution,and what is the value of the profit contribution?

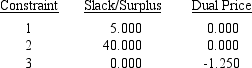

b.Which constraints are binding?

c.What are the dual prices for each resource? Interpret.

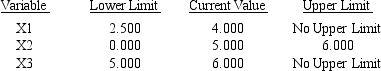

d.Compute and interpret the ranges of optimality.

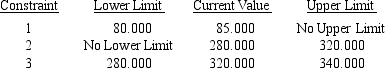

e.Compute and interpret the ranges of feasibility.

Definitions:

Bond

A fixed income instrument that represents a loan made by an investor to a borrower, typically corporate or governmental.

Zero-Coupon Bond

A bond paying no coupons that sells at a discount and provides only payment of face value at maturity.

Discount Rate

The interest rate used to discount future cash flows to their present values, often used in investment appraisal and risk assessment.

Duration

The measure of the sensitivity of the price of a bond or other debt instrument to changes in interest rates, often expressed in years.

Q13: Use the following Management Scientist output to

Q16: For an activity with more than one

Q18: For an M/G/1 system with

Q26: Draw the network for this assignment problem.<br>Min

Q30: Revenue management methodology enables an airline to

Q38: In comparing different policies using simulation,one should

Q43: A medical research project examined the relationship

Q47: For a maximization problem,the optimistic approach is

Q50: The expected value of the discrete

Q53: A 24-hour coffee/donut shop makes donuts every