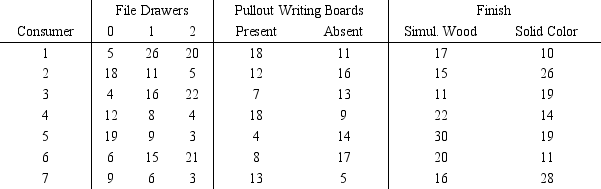

Market Pulse Research has conducted a study for Lucas Furniture on some designs for a new commercial office desk.Three attributes were found to be most influential in determining which desk is most desirable: number of file drawers,the presence or absence of pullout writing boards,and simulated wood or solid color finish.Listed below are the part-worths for each level of each attribute provided by a sample of 7 potential Lucas customers.

Suppose the overall utility (sum of part-worths)of the current favorite commercial office desk is 50 for each customer.What is the product design that will maximize the share of choices for the seven sample participants? Formulate and solve,using Lindo or Excel,this 0 - 1 integer programming problem.

Suppose the overall utility (sum of part-worths)of the current favorite commercial office desk is 50 for each customer.What is the product design that will maximize the share of choices for the seven sample participants? Formulate and solve,using Lindo or Excel,this 0 - 1 integer programming problem.

Definitions:

Passive Investment

An investment strategy involving minimal buying and selling, aiming to benefit from long-term market returns with low fees.

Four-factor Model

A financial model that expands the three-factor model (market risk, size risk, and value risk) by adding a momentum factor to explain stock returns.

Fama and French Factors

Fama and French factors are three factors—market risk, size risk, and value risk—used in explaining portfolio returns beyond the market risk measured by beta.

Semistrong-form

A theory suggesting that stock prices incorporate all publicly available information, including historical data and public news.

Q27: A video rental store has two video

Q29: Maxwell Manufacturing makes two models of felt

Q38: The expected monetary value approach and the

Q39: Scores on an endurance test for

Q40: The primary limitation of linear programming's applicability

Q43: Some linear programming problems have a special

Q44: Which of the following is the most

Q44: When applying simulation to an inventory problem,which

Q45: The network below shows the flows possible

Q81: The latest finish of an activity is