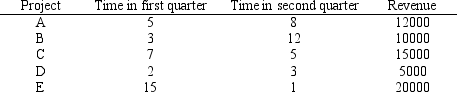

Grush Consulting has five projects to consider.Each will require time in the next two quarters according to the table below.

Revenue from each project is also shown.Develop a model whose solution would maximize revenue,meet the time budget of 25 in the first quarter and 20 in the second quarter,and not do both projects C and D.

Definitions:

Required Rate

The least yearly interest rate that persuades individuals or entities to dedicate capital to a distinct project or investment opportunity.

Net Present Value

The difference between the present value of cash inflows and the present value of cash outflows over a period of time. It's used in capital budgeting to assess the profitability of an investment or project.

Net Present Value

Net Present Value (NPV) is a financial metric that calculates the present value of all future cash flows of an investment, minus the initial investment cost.

Analyzing

The process of examining data, documents, or systems in detail in order to understand them better and make informed decisions.

Q6: If P(A|B)= .4 and P(B)= .6,then

Q7: Larkin Industries manufactures several lines of decorative

Q10: Output from a computer package is precise

Q14: The slack of any activity is the

Q15: Quarterly billing for water usage is shown

Q15: In developing the total cost for a

Q16: Show the total cost expression and calculate

Q21: Consider a project that has been modeled

Q24: The probability of going from state 1

Q75: If two paths are tied for the