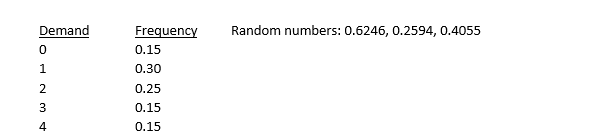

-If a simulation begins with the first random number,the third simulated value would be:

Definitions:

Futures Contracts

Legal agreements to buy or sell a particular commodity or asset at a predetermined price at a specified time in the future.

Domestic Sugar

Sugar produced and consumed within a country's borders, not involving any international trade.

Option Contract

A contract which grants the holder the right to buy or sell an underlying asset at a predetermined price within a specified time frame.

Hedge Risk

A financial strategy used to limit or offset the probability of loss from fluctuations in the prices of currencies, commodities, or securities.

Q2: The expected value of perfect information is:<br>A)-28

Q6: Once a linear programming problem has been

Q7: Cost-benefit tradeoff problems have the following type

Q11: What is the EOQ for beer?<br>A)4 cases

Q12: Simulation is especially useful for situations too

Q22: A event node in a decision tree

Q22: The binomial distribution describes the number of

Q24: If he uses Bayes' decision rule,which size

Q42: If he uses the maximum likelihood criterion,which

Q42: It is always necessary to test the