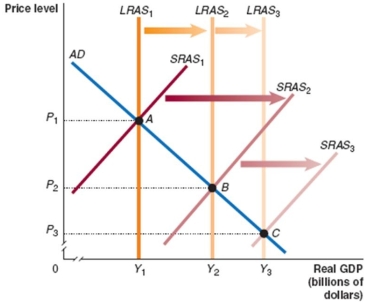

Show the effects of tax reduction and simplification using the dynamic aggregate demand and supply model.To simplify the analysis,assume that the aggregate demand curve does not change.How does the analysis change if the tax change does not change labour supply and has little or no effect on savings and investment?  _____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Definitions:

Juxtaglomerular Apparatus

The juxtaglomerular apparatus is a specialized structure in the kidney that plays a key role in regulating blood pressure and filtrate formation by managing the release of renin.

Juxtaglomerular Cells

Specialized cells in the kidneys that help regulate blood pressure by secreting renin in response to blood pressure changes.

Macula Densa

Cells of the distal convoluted tubule located at the renal corpuscle and forming part of the juxtaglomerular apparatus.

Collecting Duct

A network of tubules and ducts that function in the kidney to transport urine from the nephrons to the renal pelvis for excretion.

Q15: On January 1,2014,Wrobel Company acquired a 90

Q16: In 2015/2016,the largest share of Australian federal

Q32: Which of the following situations is one

Q43: A bank holds its reserves as _

Q69: The process of countries becoming more open

Q73: Show what will happen in the market

Q97: One reason a country does not specialise

Q98: Federal government expenditure as a proportion of

Q114: What do economists call a situation where

Q203: Limits on the flow of foreign exchange