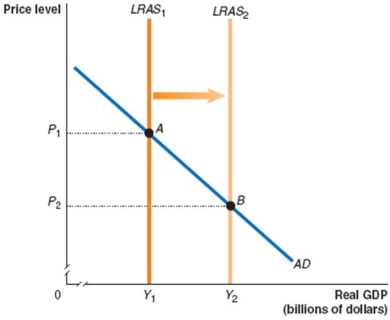

Refer to Figure 18.6 for the following questions.

Figure 18.6

-Suppose the federal government reduces income taxes.Assume that the movement from A to B in Figure 18.6 represents normal growth in the economy before the tax change.Also assume that aggregate demand does not change.If the tax change is effective and labour supply and savings increase because of the tax change,then the tax change will __________.

Definitions:

Influence

The capacity to have an effect on the character, development, or behavior of someone or something.

Perfectly Competitive Market

A market structure characterized by a large number of buyers and sellers, homogeneous products, and easy entry and exit, leading to price-taking behavior.

Variable Costs

Costs that vary directly with the level of output or business activity, such as materials and labor.

Revenues

The total income produced by a company from its activities, before any expenses are subtracted.

Q12: If real GDP decreases,<br>A) the money demand

Q34: If the bonds were originally issued at

Q50: The long-run adjustment to a supply shock

Q80: The narrowest definition of the money supply

Q106: Which of the following is not true

Q107: Japan has developed a comparative advantage in

Q111: The Reserve Bank of Australia has its

Q128: Which of the following is the best

Q137: Suppose the graph in Figure 20.3 represents

Q142: The demand by other countries for Australian