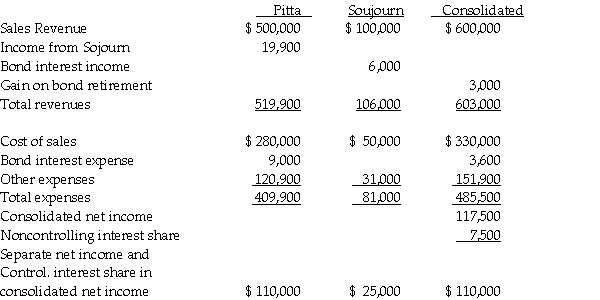

Separate company and consolidated income statements for Pitta and Sojourn Corporations for the year ended December 31,2013 are summarized as follows:

The interest income and expense eliminations relate to a $100,000,9% bond issue that was issued at par value and matures on January 1,2018.On January 2,2013,a portion of the bonds was purchased and constructively retired.

Required: Answer the following questions.

1.Which company is the issuing affiliate of the bonds payable?

2.What is the gain or loss from the constructive retirement of the bonds payable that is reported on the consolidated income statement for 2013?

3.What portion of the bonds payable is held by nonaffiliates at December 31,2013?

4.Is Sojourn a wholly-owned subsidiary? If not,what percentage does Pitta own?

5.Does the purchasing affiliate use straight-line or effective interest amortization?

6.Explain the calculation of Pitta's $19,900 income from Sojourn.

Definitions:

Tax Bracket

Categories that determine the rate at which income is taxed based on income levels.

403b Plan

A retirement savings plan available to certain employees of public schools and nonprofits, allowing them to save a portion of their salary in a tax-deferred account.

Bequest

The act of giving assets to beneficiaries through a will or estate plan.

Planning Horizon

The period over which forecasts or plans are made and future cash flows are projected, influencing decision-making processes.

Q3: Paik Corporation owns 80% of Acdol Corporation

Q4: The following are transactions for the city

Q13: Platinum City collects state sales taxes quarterly

Q29: A comprehensive annual financial report has the

Q32: Under the Bretton Woods System,central banks were

Q35: On January 1,2013,Pilgrim Imaging purchased 90% of

Q40: The balance sheet of the Addy,Bess,and Clara

Q41: Jacana Corporation paid $200,000 for a 25%

Q169: If the rate of productivity growth in

Q198: During the Chinese experience with pegging the