Pierce Manufacturing owns all of the outstanding voting common stock of Sylvia Company,as acquired several years ago when the book values and fair values of Sylvia's net assets were equal.

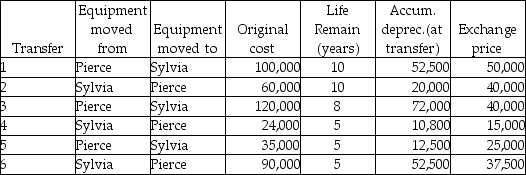

In 2013,Pierce set out to re-structure the company,and in doing so,re-aligned the manufacturing processes to streamline the use of automated equipment.As a result,they set out to move certain equipment around between the facilities owned by both Pierce and Sylvia,and ultimately agreed on the following transfers and exchange prices.It was agreed that the exchange price would be paid in cash on January 1,2014,the date the equipment was transferred.Straight-line depreciation is used and the different pieces of equipment have no salvage value.

Required:

1.Prepare the journal entry that Pierce would record for each transfer listed.

2.Prepare the journal entry that Sylvia would record for each transfer listed.

3.Prepare the consolidation worksheet entries that would be required as a result of the above transactions for 2014.

Definitions:

Style of Life

A concept introduced by Alfred Adler, referring to an individual's unique way of achieving superiority and coping with feelings of inferiority, shaped by early childhood experiences.

Traits

Enduring personality characteristics and behaviors that are consistent across different situations and time.

Temperament Traits

Innate, biologically based behavioral and emotional characteristics that are evident from early life.

Ergs

Basic instinctual drives or primary motivational forces in some psychological theories; the term originates from the work of Sigmund Freud.

Q10: What is the current annual gift amount

Q16: If the average capital balances for Bertram

Q18: If the partnership agreement provides a formula

Q19: An alumnus of a nonprofit,nongovernmental university establishes

Q24: Alf,Bill,Cam,and Dot are partners who share profits

Q27: The real exchange rate is the amount

Q113: The _ account records flows of funds

Q124: A depreciation of a country's currency is

Q214: The anchoring feature of the Bretton Woods

Q221: What does it mean when one currency