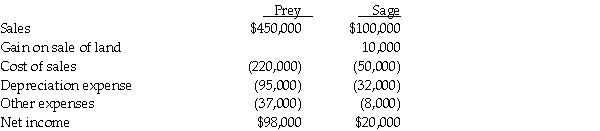

Prey Corporation created a wholly owned subsidiary,Sage Corporation,on January 1,2013,at which time Prey sold land with a book value of $90,000 to Sage at its fair market value of $140,000.Also,on January 1,2013,Prey sold to Sage equipment with a book value of $130,000 and a selling price of $165,000.The equipment had a remaining useful life of 4 years and is being depreciated under the straight-line method.The equipment has no salvage value.On January 1,2015,Sage resold the land to an outside entity for $150,000.Sage continues to use the equipment purchased from Prey.Income statements for Prey and Sage for the year ended December 31,2015 are summarized below:

Required:

At what amounts did the following items appear on the consolidated income statement for Prey and Subsidiary for the year ended December 31,2015?

1.Gain on Sale of Land

2.Depreciation Expense

3.Consolidated net income

4.Controlling interest share of consolidated net income

Definitions:

Financial Statements

Comprehensive reports that provide insights into a company's financial performance, financial position, and cash flows over a specific period.

Fair Value Adjustment-Trading

The process of adjusting the valuation of trading securities to reflect their current market value.

Adjusting Journal Entry

A journal entry made in the accounting records at the end of an accounting period to allocate income and expenditure to the correct period.

Stock Investments

Stock investments refer to the purchasing of shares in companies as a means of owning a portion of the company and potentially earning dividends or capital gains.

Q3: How much cash must Oran invest to

Q9: On January 1,2014,Adam Corporation purchased a 90%

Q12: In preparing the consolidated financial statements for

Q26: In a nongovernmental,nonprofit hospital,contractual adjustments are<br>A)the discounted

Q27: The unadjusted trial balance for the general

Q34: Warren Peace passed away,with his will leaving

Q99: Consider the market for dollars against the

Q163: Suppose that the exchange rate between the

Q209: In an open economy,contractionary monetary policy will

Q217: An economy that does not have interactions