Plover Corporation acquired 80% of Sink Inc.equity on January 1,2013,when the book values of Sink's assets and liabilities were equal to their fair values.The cost of the investment was equal to 80% of the book value of Sink's net assets.

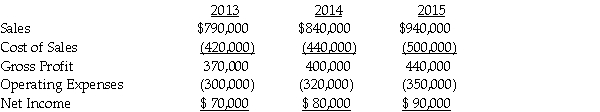

Plover separate income (excluding Sink)was $1,800,000,$1,700,000 and $1,900,000 in 2013,2014 and 2015 respectively.Plover sold inventory to Sink during 2013 at a gross profit of $48,000 and one quarter remained at Sink at the end of the year.The remaining 25 percent was sold in 2014.At the end of 2014,Plover has $25,000 of inventory received from Sink from a sale of $100,000 which cost Sink $80,000.There are no unrealized profits in the inventory of Plover or Sink at the end of 2015.Plover uses the equity method in its separate books.Select financial information for Sink follows:

Required:

Prepare a schedule to determine the controlling interest share of the consolidated net income for 2013,2014,and 2015.

Definitions:

Q2: Assume the functional currency of a foreign

Q7: Hilfmir Corporation filed for Chapter 11 bankruptcy

Q7: On January 1,2014,Klode Corporation acquired an 80%

Q8: Which of the following is a gift

Q11: Phast Corporation owns a 80% interest in

Q22: Noncontrolling interest share for Achille is<br>A)$18,000.<br>B)$25,200.<br>C)$36,200.<br>D)$72,000.

Q34: If the bonds were originally issued at

Q100: A rise in the dollar price of

Q208: The 'current account balance' is defined as

Q249: Which of the following is a 'capital