Use the following information to answer the question(s) below.

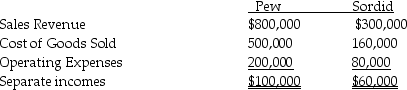

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

-The 2014 consolidated income statement showed noncontrolling interest share of

Definitions:

CCA Class

A classification system used in Canadian tax law for the depreciation of property, plant, and equipment for tax purposes.

Pre-Tax Cost

The expense of an investment or project before accounting for taxes; it reflects the gross cost.

Net Advantage

An evaluation metric that identifies the benefits minus the costs of pursuing a specific action or investment.

Depreciation Tax Shield

A tax reduction achieved through deducting depreciation expenses, lowering taxable income.

Q12: The simple trade model demonstrates that countries

Q12: The partnership of May,Novem,and Octo was dissolved.By

Q14: Match the following fund balance descriptions for

Q21: In reference to estate principal and income,which

Q23: If the Chinese yuan is pegged below

Q33: Parakeet Company has the following information collected

Q62: The 'nominal exchange rate' is the<br>A) value

Q67: Imposing tariffs in cases of dumping _.<br>A)

Q145: Fill in the values for the

Q175: Speculators who anticipate that the future value