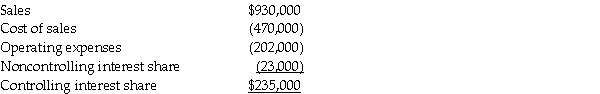

Pastern Industries has an 80% ownership stake in Sascon Incorporated.At the time of purchase,the book value of Sascon's assets and liabilities were equal to the fair value.The cost of the 80% investment was equal to 80% of the book value of Sascon's net assets.At the end of 2014,they issued the following consolidated income statement:

Shortly after the statements were issued,Pastern discovered that the 2014 intercompany sales transactions had not been properly eliminated in consolidation.In fact,Pastern had sold inventory that cost $80,000 to Sascon for $90,000,and Sascon had sold inventory that cost $50,000 to Pastern for $65,000.Half of the products from both transactions still remained in inventory at December 31,2014.

Required: Prepare a corrected income statement for Pastern and Subsidiary for 2014.

Definitions:

Self-Identification

The process by which an individual defines themselves based on their own perceptions and beliefs about their identity.

Emotional Engagement

The emotional connection a consumer has with a brand, characterized by feelings of loyalty and attachment, often the result of meaningful interactions.

Cultural Competence

The ability to understand, appreciate, and interact effectively with people of different cultures.

Node

A point in a network or system where connections are made, often used to refer to a basic unit within a data structure or a point of intersection in transport or communications networks.

Q3: Sandpiper Corporation paid $120,000 for annual property

Q13: A newly acquired subsidiary had pre-existing goodwill

Q18: Puddle Corporation acquired all the voting stock

Q22: Several years ago,Peacock International purchased 80% of

Q26: Fresh-start reporting results in<br>A)a new reporting entity

Q30: The gain from the bond purchase that

Q37: When countries agree to keep the exchange

Q60: Refer to Figure 20.2.Suppose that interest rates

Q93: During the Great Depression,many countries left the

Q103: Under the gold standard,a chance discovery of