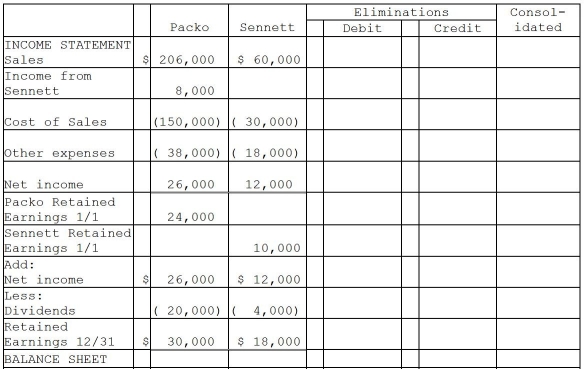

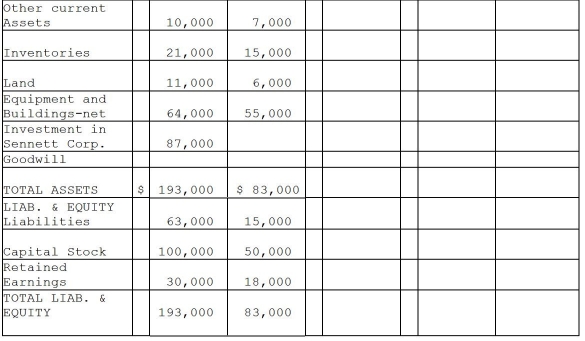

Packo Company acquired all the voting stock of Sennett Corporation on January 1,2014 for $90,000 when Sennett had Capital Stock of $50,000 and Retained Earnings of $8,000.The excess of fair value over book value was allocated as follows: (1)$5,000 to inventories(sold in 2014), (2)$16,000 to equipment with a 4-year remaining useful life(straight-line method of depreciation)and (3)the remainder to goodwill.

Financial statements for Packo and Sennett at the end of the fiscal year ended December 31,2015 (two years after acquisition),appear in the first two columns of the partially completed consolidation working papers.Packo has accounted for its investment in Sennett using the equity method of accounting.

Required:

Complete the consolidation working papers for Packo Company and Subsidiary for the year ending December 31,2015.

Definitions:

Separating Equilibrium

A concept in game theory where different types of players choose distinct strategies, allowing them to be distinguished by others.

Separating Equilibrium

A situation in a game or market where different types of participants (e.g., buyers and sellers) are sorted into different outcomes based on their types or actions.

Agents

Entities or individuals that act on behalf of others in economic models, making decisions and taking actions to achieve desired outcomes.

Marginal Products

The additional output that results from the use of an additional unit of a productive input, holding other inputs constant.

Q6: A foreign entity is a subsidiary of

Q9: Porter Corporation acquired 70% of the outstanding

Q12: GAAP requires disclosures for each reportable operating

Q12: Voluntary health and welfare organizations (VHWO)measure contributions

Q16: On December 31,2013,Pat Corporation has the following

Q18: Chapter 7 bankruptcy cases differ from Chapter

Q21: Which statement below is incorrect with respect

Q22: Bird Corporation has several subsidiaries that are

Q197: Which of the following is not included

Q200: The 'current account' includes records of a