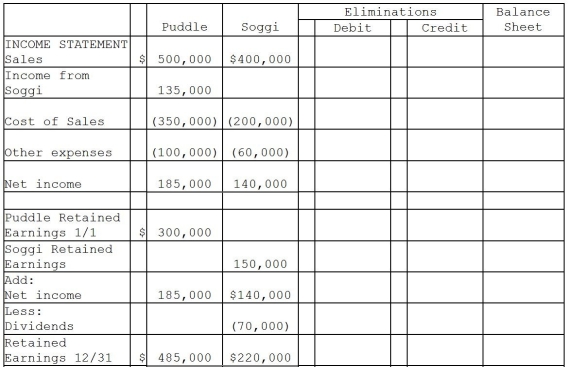

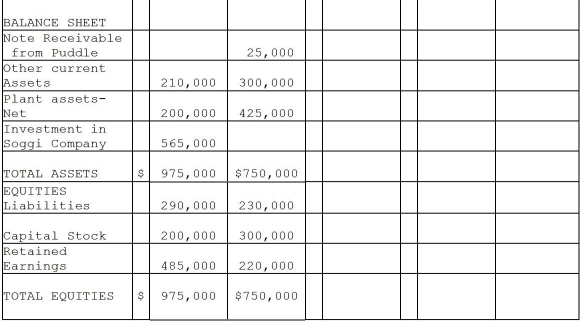

Puddle Corporation acquired all the voting stock of Soggi Company for $500,000 on January 1,2014 when Soggi had Capital Stock of $300,000 and Retained Earnings of $150,000.The book value of Soggi's assets and liabilities were equal to the fair value except for the plant assets.The entire cost-book value differential is allocated to plant assets and is fully depreciated on a straight-line basis over a 10-year period.

During 2014,Puddle borrowed $25,000 on a short-term non-interest-bearing note from Soggi,and on December 31,2014,Puddle mailed a check to Soggi to settle the note.Soggi deposited the check on January 5,2015,but receipt of payment of the note was not reflected in Soggi's December 31,2014 balance sheet.

Required:

Complete the consolidation working papers for the year ended December 31,2014.

Definitions:

Global Leaders

Individuals who possess the skills and knowledge to lead organizations or teams across diverse cultural and geographical boundaries.

Linda Hasenfratz

Linda Hasenfratz is not a key term, but a person known for her role in the business world, specifically as the CEO of Linamar Corporation, an automotive parts manufacturer.

Linamar Corporation

A Canadian multinational company specializing in the manufacturing of precision automotive components, as well as powertrain systems.

Canadian Organizations

Organizations that are based in Canada or operate primarily within the Canadian context.

Q4: On January 2,2014,Pal Corporation sold warehouse equipment

Q6: On January 1,2014,Wrobel Company acquired a 90

Q17: Pollek Corporation paid $16,200 for a 90%

Q21: When the bankruptcy court grants an order

Q28: For internal decision-making purposes,Calam Corporation's operating segments

Q35: In reference to accounting for trusts or

Q36: On January 1,2013,Starling Corporation held an 80%

Q98: Which of the following is a source

Q172: If you know that a country's net

Q237: Assume that the Thai government wants to