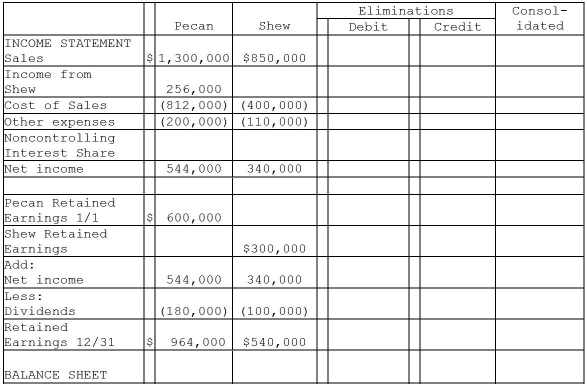

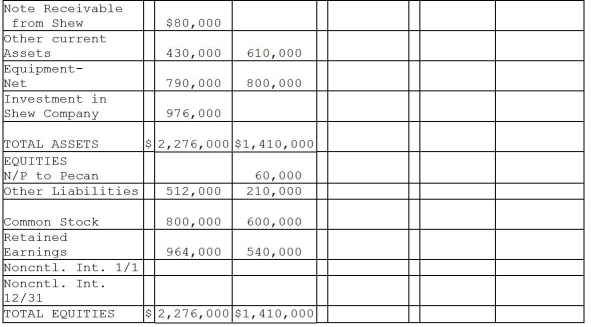

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2,2014 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000.The book value and fair value of Shew's assets and liabilities were equal except for equipment.The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2014,Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan,and on December 31,2014,Shew mailed a check for $20,000 to Pecan in partial payment of the note.Pecan deposited the check on January 4,2015,and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31,2014.

Definitions:

Premium Amortization

The process of gradually writing off the initial premium paid on a bond above its par value over the life of the bond.

Bonds

Bonds are financial instruments representing a loan made by an investor to a borrower, typically corporate or governmental, which pays interest over time and returns the principal at maturity.

Effective Yield

The total yield on an investment, taking into account the compounding of interest, as opposed to just the nominal rate.

Bond Issue Costs

Expenses associated with the issuance of bonds, including legal fees, printing costs, and commissions, that are typically amortized over the life of the bonds.

Q2: The partnership of Georgia,Holly,and Izzy was dissolved,and

Q6: Under the Uniform Probate Code,the term "personal

Q15: The Trasque Hospital is a nongovernmental,not-for-profit hospital.During

Q16: Suppose that the current equilibrium exchange rate

Q22: Subsequent to an acquisition,the parent company and

Q26: Platt Corporation paid $87,500 for a 70%

Q37: The following information was taken from the

Q74: A currency exchange rate system under which

Q153: a.Suppose that the current equilibrium exchange rate

Q201: If Australian demand for purchases of British