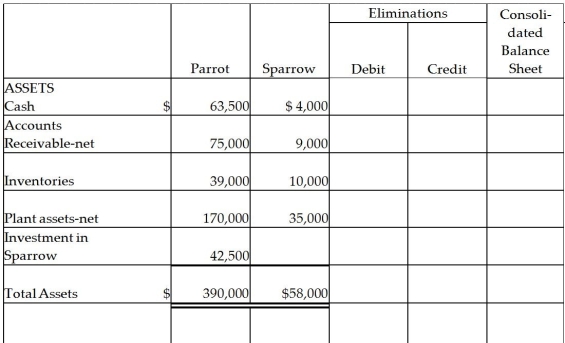

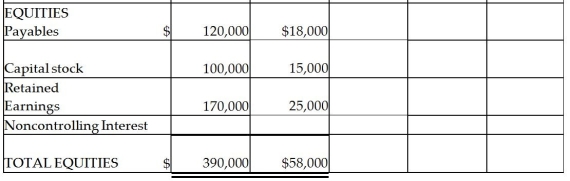

Parrot Inc.acquired an 85% interest in Sparrow Corporation on January 2,2014 for $42,500 cash when Sparrow had Capital Stock of $15,000 and Retained Earnings of $25,000.Sparrow's assets and liabilities had book values equal to their fair values except for inventory that was undervalued by $2,000.Balance sheets for Parrot and Sparrow on January 2,2014,immediately after the business combination,are presented in the first two columns of the consolidated balance sheet working papers.

Required:

Complete the consolidation balance sheet working papers for Parrot and subsidiary at January 1,2014.

Definitions:

Per Se Violation

A legal doctrine in antitrust law where certain business activities are considered illegal in themselves, regardless of their harm or outcomes.

Antitrust Laws

Legislation enacted to prevent new monopolies from forming and promote competition by prohibiting agreements, practices, or mergers that restrain trade or reduce competition.

Conspiracy

An agreement between two or more persons to commit an illegal act or to accomplish a legal end through illegal actions.

Price-Fixing

An illegal agreement between parties to sell a product at a set price, limiting competition and manipulating the market.

Q1: What is an advantage of filing a

Q5: On January 1,2014,Palling Corporation purchased 70% of

Q26: Bart Company purchased a 30% interest in

Q30: On March 1,2014,Amber Company sold goods to

Q30: Which statement is correct in describing the

Q31: What is the amount of total assets?<br>A)$1,380,000<br>B)$1,402,000<br>C)$1,470,000<br>D)$1,875,000

Q37: Which of the following is correct? The

Q39: Which one of the following statements is

Q49: If net primary income and net secondary

Q132: Investors who sell a country's currency in