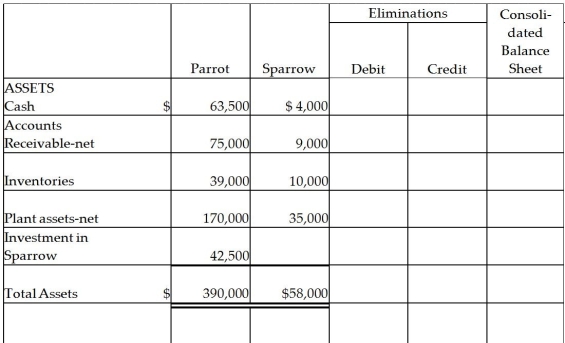

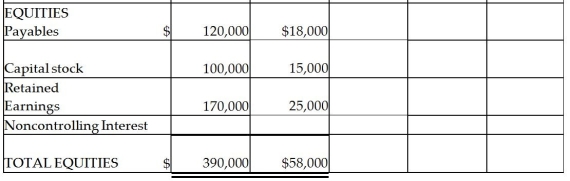

Parrot Inc.acquired an 85% interest in Sparrow Corporation on January 2,2014 for $42,500 cash when Sparrow had Capital Stock of $15,000 and Retained Earnings of $25,000.Sparrow's assets and liabilities had book values equal to their fair values except for inventory that was undervalued by $2,000.Balance sheets for Parrot and Sparrow on January 2,2014,immediately after the business combination,are presented in the first two columns of the consolidated balance sheet working papers.

Required:

Complete the consolidation balance sheet working papers for Parrot and subsidiary at January 1,2014.

Definitions:

Domestic Violence

Physical, sexual, emotional, economic, or psychological actions or threats of actions that influence another person within a household.

Type 1 Diabetes

An autoimmune disease where the pancreas produces little to no insulin, requiring individuals to manage their blood sugar levels through insulin therapy and lifestyle adjustments.

Homeless Persons

Individuals who lack a fixed, regular, and adequate nighttime residence, leading to living in shelters, streets, or other precarious situations.

Census Tracts

Small, relatively permanent statistical subdivisions of a county or equivalent entity, designed to be relatively homogeneous units regarding population characteristics.

Q1: Park Incorporated purchased a 70% interest in

Q3: Sandpiper Corporation paid $120,000 for annual property

Q10: The primary goal behind consolidating financial statements

Q12: Wild West,Incorporated (a U.S.corporation)sold inventory to a

Q16: What is the reported amount for the

Q18: Puddle Corporation acquired all the voting stock

Q21: In reference to estate principal and income,which

Q35: Under GAAP,for nonprofit,nongovernmental entities,an unconditional transfer of

Q39: Selvey Inc.is a wholly-owned subsidiary of Parsfield

Q40: The balance sheet of the Addy,Bess,and Clara