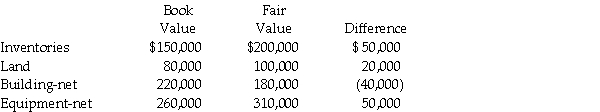

Paster Corporation was seeking to expand its customer base,and wanted to acquire a company in a market area it had not yet served.Paster determined that the Semma Company was already in the market they were pursuing,and on January 1,2013,purchased a 25% interest in Semma to assure access to Semma's customer base.Paster paid $800,000,at a time when the book value of Semma's net equity was $3,000,000.Semma's book values equaled their fair values except for the following items:

Required:

Prepare a schedule to allocate any excess purchase cost to identifiable assets and goodwill.

Definitions:

Turnaround Strategy

Strategies implemented by a firm in distress to recover from financial instability, involving restructuring operations to regain profitability.

Retrenchment

A strategic reduction of business activities or workforce by a company to cut expenses and stabilize financially.

Turnaround Strategy

A set of actions taken by a company in an attempt to reverse a period of decline or poor performance.

Outplacement Counseling

Support services provided by organizations to help former employees transition to new jobs, offering career guidance, resume advice, and interview preparation.

Q5: On January 1,2011,a Voluntary Health and Welfare

Q7: The financial statements of proprietary funds are

Q7: The following are transactions for the city

Q10: If the sale referred to above was

Q11: Which of the following is correct?<br>A)No consolidation

Q13: On January 2,2013 Palta Company issued 80,000

Q13: Controlling interest share of consolidated net income

Q23: On January 2,2013 Carolina Clothing issued 100,000

Q36: A single creditor<br>A)can never file a petition

Q37: Jeale Corporation is preparing its interim financial