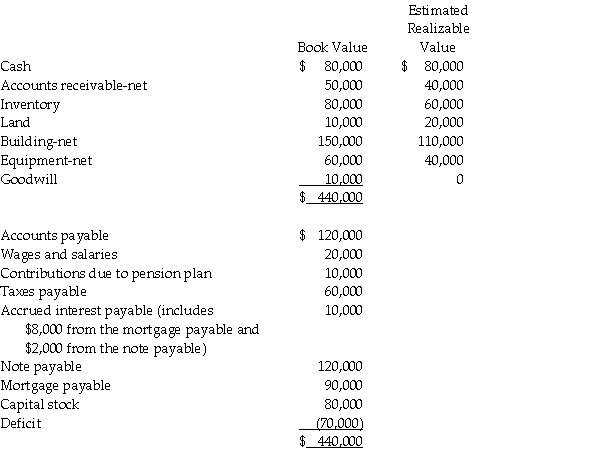

CommTex Corporation is liquidating under Chapter 7 of the Bankruptcy Act.The accounts of CommTex at the time of filing are summarized as follows:

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.The note payable is secured with the equipment,but the interest on the note is unsecured.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and pension plan contributions relate to services rendered within 6 months of filing the petition for bankruptcy;neither exceeds $4,000 per employee.Liquidation expenses are expected to be $40,000.

Required:

1.Prepare a schedule showing the priority rankings of the creditors and the expected payouts.

2.Devendor Corporation was a supplier to CommTex Corporation and at the time of CommTex's bankruptcy filing,Devendor's account receivable from CommTex was $25,000.On the basis of the estimates,how much can Devendor expect to receive?

Definitions:

Cash Sales

Transactions where payment for goods or services is made immediately in cash or via electronic means rather than on credit.

Time Value

The concept that money available today is worth more than the same amount in the future due to its potential earning capacity, often used in evaluating investment opportunities.

Inventory Control

The process of managing inventory levels, orders, sales, and deliveries to ensure the right quantity of stock is available at the right time.

Sales Rise

An increase in the amount of products or services sold by a business within a specific period.

Q2: Assume the functional currency of a foreign

Q3: On December 31,2013,Peris Company acquired Shanta Company's

Q4: In addition to 1 m = 39.37

Q5: The unadjusted trial balance for the general

Q16: Spott is a 75%-owned subsidiary of Penthal.On

Q18: Voluntary health and welfare organizations classify fund-raising

Q29: Gargantuan Bank has loaned money in two

Q30: Record the following transactions for Porter Hospital,a

Q36: Under the current GAAP,Goodwill arising from a

Q37: The Leo,Mark and Natalie Partnership had the