Use the following information to answer the question(s) below.

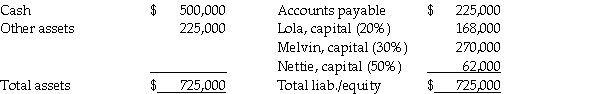

Lola,Melvin,and Nettie are in the process of liquidating their partnership.Since it may take several months to convert the other assets into cash,the partners agree to distribute all available cash immediately,except for $12,000 that is set aside for contingent expenses.The balance sheet and residual profit and loss sharing percentages are as follows:

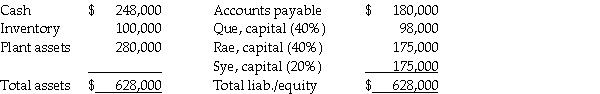

-Que,Rae,and Sye are in the process of liquidating their partnership.Sye has agreed to accept the inventory,which has a fair value of $60,000,as part of her settlement.A balance sheet and the residual profit and loss sharing percentages are as follows:

If the partners then distribute the available cash using a safe payments schedule,Sye will receive

Definitions:

Cultural Considerations

Factors that recognize and respect the beliefs, languages, interpersonal styles, and behaviors of individuals shaped by their cultural background.

Acculturation and Enculturation

The processes through which individuals learn and adopt the cultural habits of another group (acculturation) and the cultural habits of their native group (enculturation), respectively.

Helper Bias

The tendency for individuals providing support or assistance to others to have preconceived notions or biases that can affect their judgment or behavior.

Process-oriented Goals

Objectives that focus on the steps, experiences, or methods required to achieve a specific outcome, emphasizing the journey rather than the end result.

Q4: DeFunk Corporation is being liquidated under Chapter

Q15: Anthony and Cleopatra create a joint venture

Q19: On January 1,2014 Saffron Co.recorded a $40,000

Q23: With respect to the bond purchase,the consolidated

Q27: Earth Company,Fire Incorporated,and Wind Incorporated created a

Q29: Pheasant Corporation owns 80% of Sal Corporation's

Q31: Slickton Corporation,a U.S.holding company,enters into a forward

Q32: The partners of the Minion,Nocti and Overly

Q34: An object is moving to the right,and

Q35: Preacquisition income for 2013 is<br>A)$50,000.<br>B)$35,000.<br>C)$44,000.<br>D)$36,000.