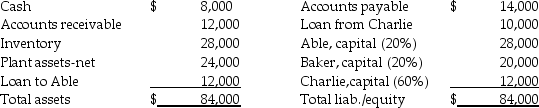

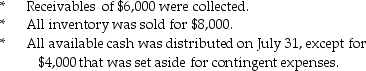

The percentages shown are the residual profit and loss sharing ratios.The partners dissolved the partnership on July 1,2014,and began the liquidation process.During July the following events occurred:

The percentages shown are the residual profit and loss sharing ratios.The partners dissolved the partnership on July 1,2014,and began the liquidation process.During July the following events occurred:

-The book value of the partnership equity (i.e.,total equity of the partners) on June 30,2014 is

Definitions:

Fair Value

An estimate of the market value of an asset or liability, based on the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants.

Consideration

In legal and accounting terms, it refers to the value, either monetary or a promise of action, that is exchanged between parties in a contract.

Residual Value

the estimated value that an asset will have at the end of its useful life.

Straight-Line Method

A depreciation technique that allocates an equal portion of an asset’s initial cost to each year of its useful life.

Q2: In a not-for-profit,private university,the federal grant funds

Q9: Palmquist Corporation and its 80%-owned subsidiary,Sadler Corporation,are

Q10: What partnership capital will Robert have after

Q12: The following exact conversion equivalents are given:

Q15: In the eliminating/adjusting entries on consolidation working

Q22: A nongovernmental,not-for-profit entity is subject to:<br>I.GASB<br>II.FASB<br>A)I only<br>B)II

Q23: On February 1,2014,George,Hamm,and Ishmael began a partnership

Q31: The key focus of government fund accounting

Q31: For each of the 12 accounts listed

Q32: Penguin Corporation acquired a 60% interest in