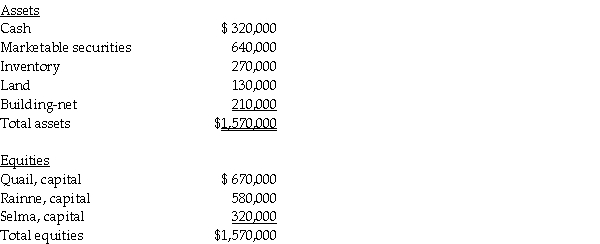

A summary balance sheet for the partnership of Quail,Rainne and Selma on December 31,2014 is shown below.Partners Quail,Rainne and Selma allocate profit and loss in their respective ratios of 6:3:1.

The partners agree to admit Trask for a one-tenth interest.The fair market value for partnership land is $260,000,and the fair market value of the inventory is $370,000.

Required:

1.Record the entry to revalue the partnership assets prior to the admission of Trask.

2.Calculate how much Trask will have to invest to acquire a 10% interest.

3.Assume the partnership assets are not revalued.If Trask paid $300,000 to the partnership in exchange for a 10% interest,what would be the bonus that is allocated to each partner's capital account?

Definitions:

Q2: In a not-for-profit,private university,the federal grant funds

Q2: What goodwill will be recorded?<br>A)$ 80,000<br>B)$240,000<br>C)$320,000<br>D)$400,000

Q7: The figure shows the velocity of a

Q11: Pew Corporation (a U.S.corporation)acquired all of the

Q25: The wavelength of a certain laser is

Q31: Parrot Corporation acquired a 70% interest in

Q32: Stello Corporation's stockholders' equity on December 31,2014

Q34: On January 1,2014,Paste Unlimited,a U.S.company,acquired 100% of

Q35: A bankruptcy petition filed by a firm's

Q50: A car is being towed at constant