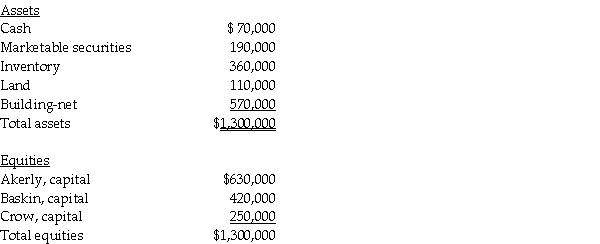

A summary balance sheet for the Akerly,Baskin,and Crow partnership on December 31,2014 is shown below.Partners Akerly,Baskin,and Crow allocate profit and loss in their respective ratios of 3:2:1.The partnership agreed to pay partner Baskin $500,000 for his partnership interest upon his retirement from the partnership on January 1,2015.The partnership financials on January 1,2015 are:

Required:

Prepare the journal entry to reflect Baskin's retirement from the partnership:

1.Assuming a bonus to Baskin.

2.Assuming a revaluation of total partnership capital based on excess payment.

3.Assuming goodwill equal to the excess payment is recorded.

Definitions:

Rheumatoid Arthritis (RA)

An autoimmune disease that causes chronic inflammation of the joints and other parts of the body, leading to pain, swelling, and potential loss of function.

Control Inflammation

The process or measures taken to reduce or manage the body's inflammatory response to injury, infection, or chronic conditions.

Immune Response

The body's defensive reaction to foreign substances or pathogens, involving recognition and attack to eliminate the invaders.

Erythema

Redness of the skin typically caused by increased blood flow due to inflammation, injury, or infection.

Q5: The profit and loss sharing agreement for

Q5: The City's municipal golf course had the

Q8: A Capital Projects Fund awards the construction

Q10: On December 18,2014,Wabbit Corporation (a U.S.Corporation)has a

Q12: Salli Corporation regularly purchases merchandise from their

Q21: According to FASB Statement No.141,liabilities assumed in

Q21: Required:<br>1.Prepare a schedule to allocate income or

Q24: An airplane that is flying level needs

Q36: Assume Paris's inventory account had a book

Q45: The height of the ceiling in a