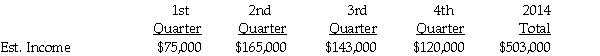

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2014,by quarter,is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2014.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2014.

Definitions:

Finished Goods Inventory

Products completed and ready for sale, yet remain unsold.

Underapplied Manufacturing Overhead

Occurs when the allocated manufacturing overhead costs are less than the actual overhead costs incurred.

Work in Process

Inventory representing partially completed goods, which includes labor, material, and overhead costs incurred so far.

Journal Entry

A record in accounting that notes a specific financial transaction in the ledgers of a business.

Q1: Prepare journal entries to record the following

Q2: On January 1,2013,Platt Corporation purchased a 30%

Q3: Which type of fund is used to

Q8: Plateau Incorporated bought 60% of the common

Q12: For each of the following events or

Q14: Under the provisions of FASB Statement No.141R,in

Q16: On November 1,2014,the Yankee Corporation,a US corporation,purchased

Q27: A private,not-for-profit university received donations of $800,000

Q28: In a business combination,which of the following

Q30: Scientists use the metric system chiefly because