Note to Instructor: This exam item is similar to Exercise 3 except that the exchange rates have been changed and the temporal method is used instead of the current rate method.

The Polka Corporation,a U.S.corporation,formed a British subsidiary on January 1,2014 by investing 550,000 British pounds (£)in exchange for all of the subsidiary's no-par common stock.The British subsidiary,Stripe Corporation,purchased real property on April 1,2014 at a cost of £500,000,with £100,000 allocated to land and £400,000 allocated to the building.The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value.The U.S.dollar is Stripe's functional currency,but it keeps its records in pounds.The British economy does not experience high rates of inflation.Exchange rates for the pound on various dates are:

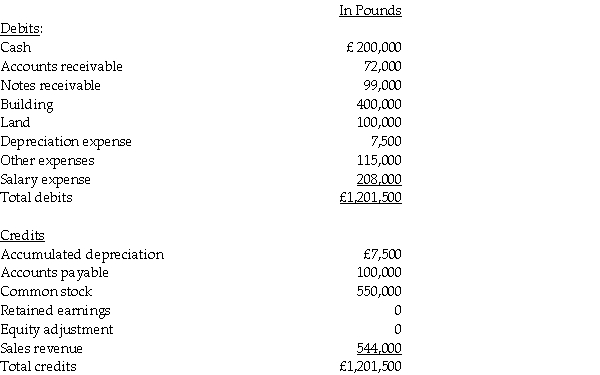

Stripe's adjusted trial balance is presented below for the year ended December 31,2014.

Required:

Prepare Stripe's:

1.Remeasurement working papers;

2.Remeasured income statement;and

3.Remeasured balance sheet.

Definitions:

Gross Requirement

The total demand for an item or component before considering inventory on hand or scheduled receipts, typically used in production and inventory planning.

Q5: The City's municipal golf course had the

Q14: On January 1,2014,Jeff Company acquired a 90%

Q20: At any point in time,a government will

Q21: Two identical stones are dropped from rest

Q22: A partner assigned his partnership interest to

Q23: A ball is thrown directly upward and

Q25: Passerby International purchased 80% of Standaround Company's

Q27: What is the purpose of interim reporting?<br>A)Provide

Q36: An 8.0-g bullet is shot into a

Q39: On November 1,2014,Moddel Company (a U.S.corporation)entered into