Use the following information to answer the question(s) below.

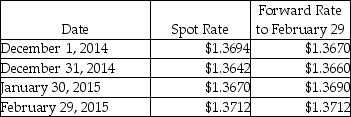

On December 1,2014,Thomas Company,a U.S.corporation,purchases inventory from a vendor in Italy for 400,000 euros.Payment is due in 90 days.To hedge the transaction,Thomas signs a forward contract to buy 400,000 euros in 90 days at $1.3670.Thomas uses a discount rate of 6% (present value factor for 30 days = .9950;60 days = .9901;90 days = .9851) .Assume the forward contract will be settled net and this is a cash flow hedge.Currency exchange rates are shown below:

-What is the fair value of the forward contract at February 29?

Definitions:

Useful Life

The estimated period over which a fixed asset is expected to be usable by an organization.

Discount Rate

The interest rate used to discount future cash flows to their present value, often used in investment valuation and project evaluation.

Annual Net Cash Inflows

The total amount of cash received minus cash expenses over a year.

Net Present Value

The discrepancy in the present valuation of incoming and outgoing cash flows within a certain timeframe.

Q13: Consider what happens when you jump up

Q15: In the figure,determine the character of the

Q17: On May 1,2014,Listing Corporation receives inventory items

Q18: How does GAAP view interim accounting periods?<br>A)As

Q20: For general projectile motion,when the projectile is

Q30: Austin contributes his computer equipment to the

Q30: A child on a sled starts from

Q31: A ball rolls across a floor with

Q60: Which one of the following free-body diagrams

Q120: A small glider is coasting horizontally when