Use the following information to answer the question(s) below.

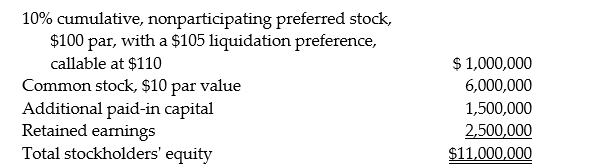

On January 1, 2014, Pardy Corporation acquired a 70% interest in the common stock of Salter Corporation for $7,000,000 when Salter's stockholders' equity was as follows: There were no preferred dividends in arrears on January 1, 2014. There are no book value/fair value differentials.

There were no preferred dividends in arrears on January 1, 2014. There are no book value/fair value differentials.

-Salter has a 2014 net loss of $200,000.No dividends are declared or paid in 2014.What is the change in Pardy's Investment in Salter for the year ending December 31,2014?

Definitions:

Federal Income Tax

A tax levied by the United States federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Debtor in Possession

A debtor who retains possession and control of their assets while undergoing a reorganization under bankruptcy law, typically in Chapter 11 bankruptcy proceedings.

Liquidating

The process of closing a business and distributing its assets to claimants, often in the event of bankruptcy.

Assets

Resources or items of value owned by an individual or business, which can be used to cover liabilities or generate income.

Q4: The figure shows a graph of the

Q5: The position of an object as a

Q5: The coefficient of the restitution of an

Q5: Alitech Corporation is liquidating under Chapter 7

Q11: A soccer ball is released from rest

Q13: The proceeds from a bond issuance for

Q18: A block is on a frictionless horizontal

Q18: Pelmer has a foreign subsidiary,Sapp Corporation of

Q21: Which of the following procedures is acceptable

Q32: Following the accounting concept of a business