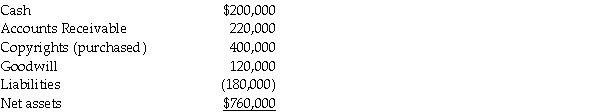

On January 2,2013,Pilates Inc.paid $700,000 for all of the outstanding common stock of Spinning Company,and dissolved Spinning Company.The carrying values for Spinning Company's assets and liabilities are recorded below.

On January 2,2013,Spinning anticipated collecting $185,000 of the recorded Accounts Receivable.Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own,and also unrecorded patents with a fair value of $100,000.

Required:

Calculate the amount of goodwill that will be recorded on Pilate's balance sheet as of the date of acquisition.Then record the journal entry Pilates would record on their books to record the acquisition.

Definitions:

Surplus Revenues

Funds that exceed the expected or required amounts, often discussed in the context of governmental or organizational budgets.

Not-for-Profit Corporations

Organizations that operate for purposes other than making a profit, often focused on charitable, educational, or social missions.

Flagship Store

The leading retail store of a brand, often containing the widest range of products and depicting the brand's identity.

Foreign Corporation

A business entity that is incorporated under the laws of a country different from where it conducts its operations or has its principal business activities.

Q5: For 2012,2013,and 2014,Squid Corporation earned net incomes

Q16: Sandy Corporation's stockholders' equity on December 31,2014

Q17: Drawings<br>A)are advances to a partnership.<br>B)are loans to

Q25: An athlete stretches a spring an extra

Q26: The exchange rates between the Australian dollar

Q36: A single creditor<br>A)can never file a petition

Q36: What is the fair value of the

Q41: Jacana Corporation paid $200,000 for a 25%

Q68: A series of weights connected by very

Q84: A pilot drops a package from a