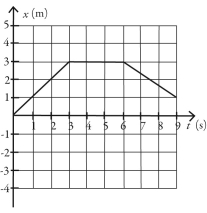

The figure shows the position of an object as a function of time. During the time interval from time

t = 0.0 s and time t = 9.0 s

(a)what is the length of the path the object followed?

(b)what is the displacement of the object?

Definitions:

Taxable Income

is the amount of income used to calculate how much tax an individual or a company owes to the government, after all deductions and exemptions.

Temporary Difference

A difference between the book value and tax value of an asset or liability that results in taxable or deductible amounts in future years.

Tax Provision

An amount recorded in advance for expected future tax payments due to governmental regulations and business operations.

Interperiod Tax Allocation

The practice of distributing income tax expenses over different accounting periods to match taxes with the revenues they are associated with.

Q11: On January 1,2014,Penny Company acquired a 90%

Q12: A stock person at the local grocery

Q12: A slender uniform rod 100.00 cm long

Q14: What is the magnitude of <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6682/.jpg"

Q27: If the average capital for Bertram and

Q27: Sally Corporation's stockholders' equity on December 31,2014

Q28: If a U.S.company is preparing a journal

Q29: How much should the Parminter's Investment in

Q73: In the figure,a block of mass m

Q119: A 4.00-kg block rests between the floor