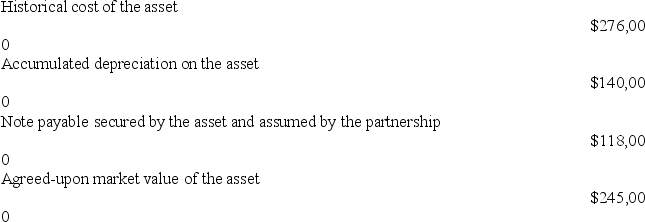

Dalworth and Minor have decided to form a partnership.Minor is going to contribute a depreciable asset to the partnership as her equity contribution to the partnership.The following information regarding the asset to be contributed by Minor is available:

Based on this information,Minor's beginning equity balance in the partnership will be:

Definitions:

Contracting Parties

The entities or individuals that agree to, sign, and are bound by a contract.

Assignment

Assignment involves the transfer of rights or obligations from one party to another, often seen in contracts, leases, or financial agreements.

Supporting Consideration

Consideration provided by a party in a contract that underpins the agreement, ensuring it is legally binding.

Assignee

An individual or entity to whom rights or interests have been transferred by another.

Q43: A company is setting aside $21,354 today,and

Q51: If a Σ<sup>-</sup> particle at rest decays

Q61: Aaron invests $98,000 in the partnership.The amount

Q62: When a photoelectric surface is illuminated with

Q69: Americium-243 has a decay constant of

Q75: The future value of $100 compounded semiannually

Q106: When an investment in an equity security

Q111: If a U.S.Company's credit sale to an

Q144: What is Barber's return on equity?<br>A) 41.3%<br>B)

Q165: Partners in a partnership are taxed on