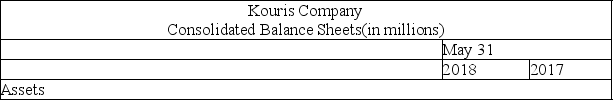

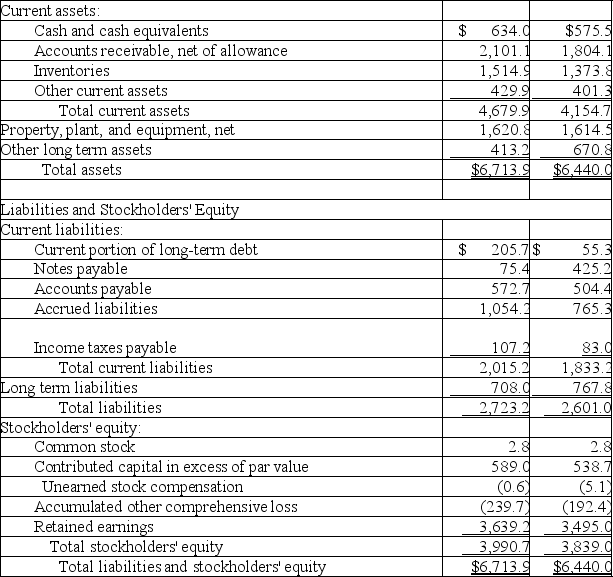

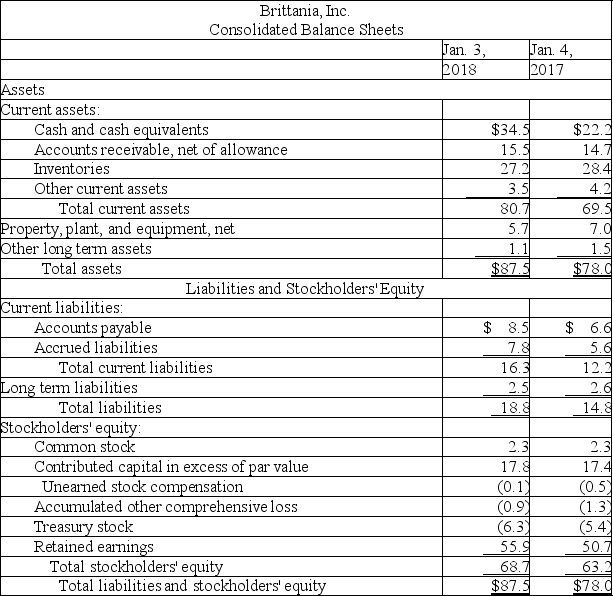

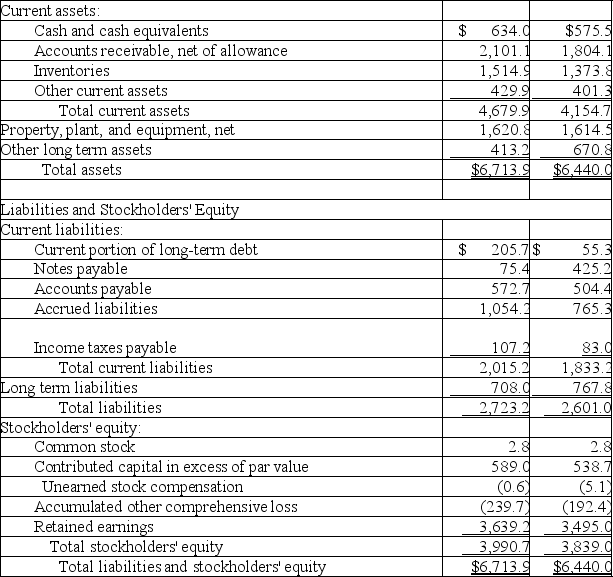

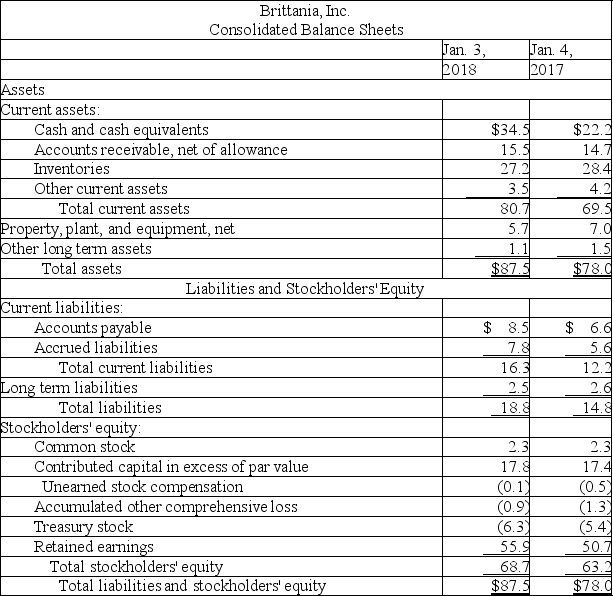

The following summaries from the income statements and balance sheets of Kouris Company and Brittania,Inc.are presented below.

(1)For both companies for 2018,compute the:

(a)Current ratio

(b)Acid-test ratio

(c)Accounts receivable turnover

(d)Inventory turnover

(e)Days' sales in inventory

(f)Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2)For both companies for 2018,compute the:

(a)Profit margin ratio

(b)Return on total assets

(c)Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Kouris Company Consolidated Statement of Income May 31,2018 (in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Income before effect of accounting change Cumulative effect of accounting change, net of tax Net income $10,697.06,313.63,383.41,137.642.979.91,123.0382.9740.1266.1474.0$474.0

Brittania, Inc. Consolidated Statement of Income January 3, 2018 (in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Net income $133.587.346.237.38.9(0.1)0.39.13.9$5.2

Definitions:

Needle

A slender, pointed instrument typically made of metal, used for sewing, puncturing, or injecting.

Incubation Period

The interval between exposure to infection and the appearance of the first symptom.

Rubeola Measles

A highly contagious viral infection characterized by a red skin rash; also known simply as measles.

IV Bag

A plastic bag containing liquids, such as saline solution, medications, or nutrients for intravenous infusion.