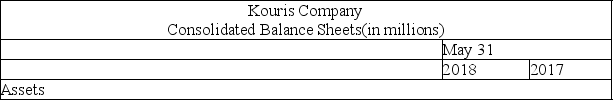

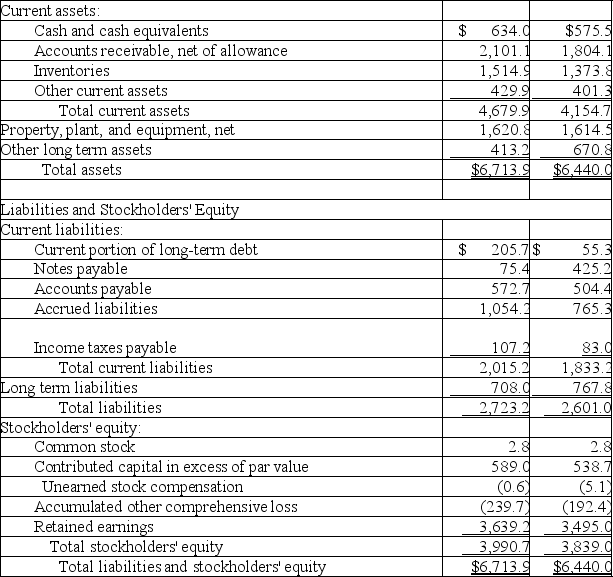

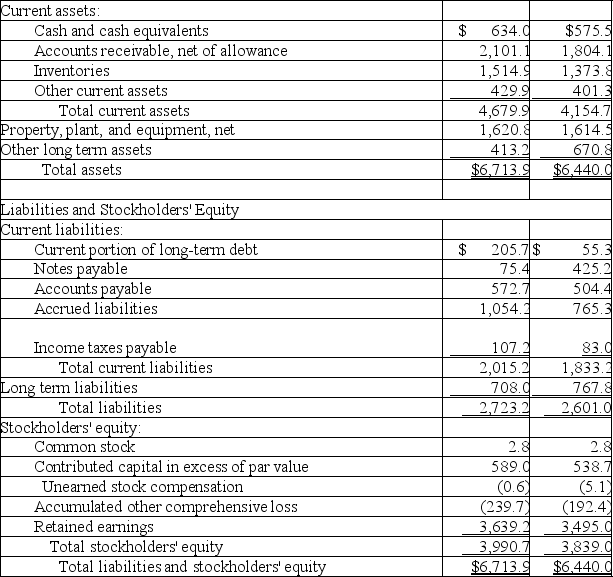

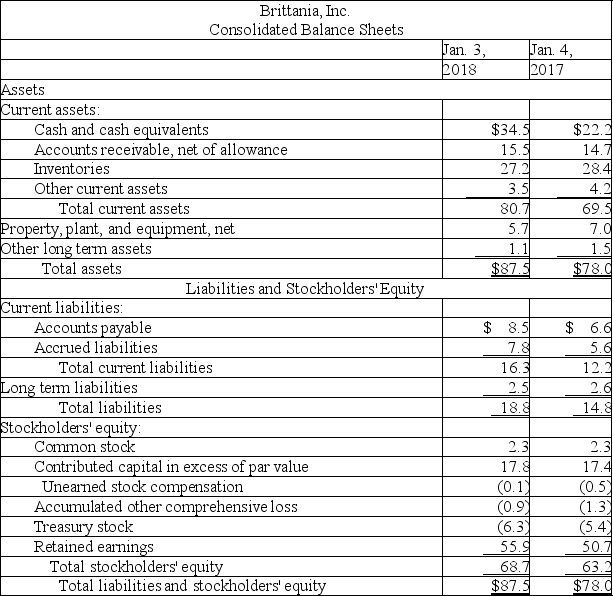

The following summaries from the income statements and balance sheets of Kouris Company and Brittania,Inc.are presented below.

(1)For both companies for 2018,compute the:

(a)Current ratio

(b)Acid-test ratio

(c)Accounts receivable turnover

(d)Inventory turnover

(e)Days' sales in inventory

(f)Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2)For both companies for 2018,compute the:

(a)Profit margin ratio

(b)Return on total assets

(c)Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Kouris Company Consolidated Statement of Income May 31,2018 (in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Income before effect of accounting change Cumulative effect of accounting change, net of tax Net income $10,697.06,313.63,383.41,137.642.979.91,123.0382.9740.1266.1474.0$474.0

Brittania, Inc. Consolidated Statement of Income January 3, 2018 (in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Net income $133.587.346.237.38.9(0.1)0.39.13.9$5.2

Definitions:

Psychodynamic Approach

A psychological perspective that emphasizes unconscious processes and childhood experiences in shaping behaviors and emotional states.

Free Association

A therapeutic technique in psychoanalysis where the patient voices their thoughts without reservation, revealing unconscious thoughts and feelings.

Analytic Thinking

The process of evaluating and dissecting complex problems or concepts to understand their components and derive conclusions.

Structural Model

An abstract representation that illustrates the framework of an object, system, or concept, detailing the arrangement and interaction of its parts.