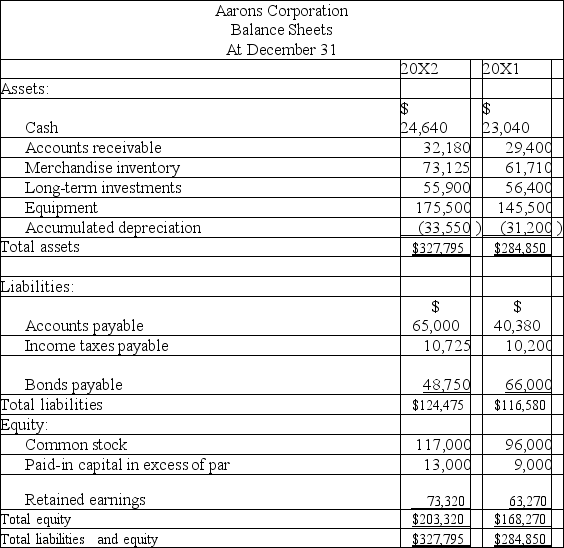

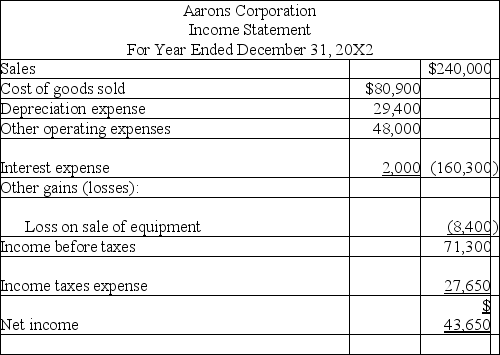

The following information is available for the Aarons Corporation:

Additional information:

(1)There was no gain or loss on the sales of the long-term investments,nor on the bonds retired.

(2)Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3)New equipment was purchased for $67,550 cash.

(4)Cash dividends of $33,600 were paid.

(5)Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for calendar-year 20X2 using the indirect method.

Definitions:

Q13: Percy Corporation was formed on January 1.The

Q26: Adonis Corporation issued 10-year,8% bonds with a

Q46: When preparing the operating activities section of

Q47: Zhang Company reported Cost of goods sold

Q53: Bonds that are scheduled for maturity on

Q94: If a company is using the indirect

Q130: A discount reduces the interest expense of

Q170: A corporation is a legal entity separate

Q191: Global Corporation had 50,000 shares of $20

Q194: Dividing ending inventory by cost of goods