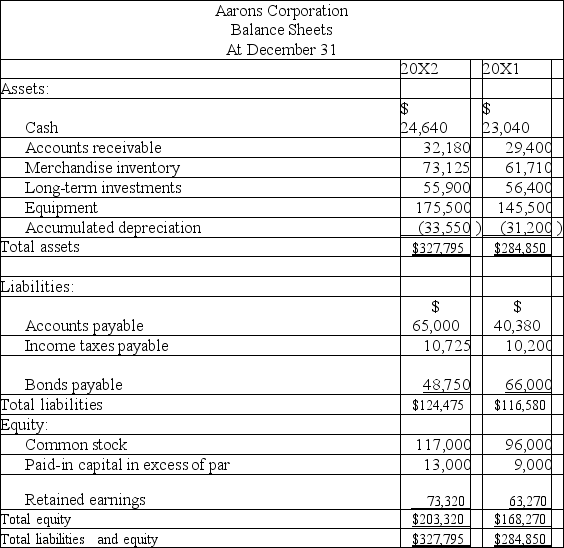

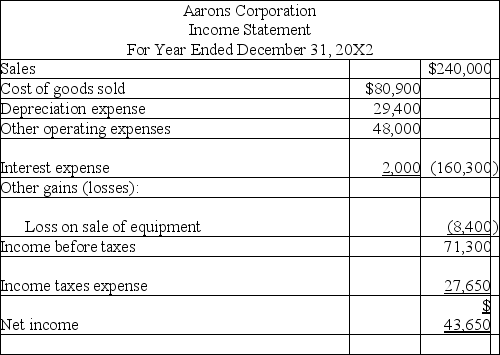

The following information is available for the Aarons Corporation:

Additional information:

(1)There was no gain or loss on the sales of the long-term investments,nor on the bonds retired.

(2)Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3)New equipment was purchased for $67,550 cash.

(4)Cash dividends of $33,600 were paid.

(5)Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for calendar-year 20X2 using the indirect method.

Definitions:

Left Cerebral Hemisphere

The left side of the brain, typically associated with tasks that involve logic, language, and analytical thinking.

Arithmetic Problems

Mathematical challenges that involve the manipulation of numbers through operations like addition, subtraction, multiplication, and division.

Familiar Melodies

Tunes or musical sequences that are widely recognized by a large number of people, often evoking a sense of nostalgia or familiarity.

Neurogenesis

The creation of new brain cells, known as neurons.

Q24: Alvez reports net income of $305,000 for

Q28: Achieving an increased return on common stock

Q31: A corporation with $10 par common stock

Q46: When preparing the operating activities section of

Q87: A corporation had the following stock

Q140: Book value per share reflects the value

Q157: When preparing a statement of cash flows

Q225: Carducci Corporation reported Net sales of $3.6

Q228: Explain the amortization of a bond discount.Identify

Q249: Managers only use the cash flow statement