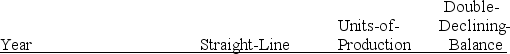

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1.The company estimates the machine will produce 1,050,000 units of product during its life.It actually produces the following units for the first 2 years: Year 1,260,000; Year 2,275,000.Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method.Show calculation of amounts below the table.

Year 1

Year 2

Definitions:

Reliable

The quality of being consistently good in quality or performance, able to be trusted.

Valid

Having a sound basis in logic or fact; accurately reflecting the situation or being legally binding.

Information Management

The process of collecting, storing, organizing, protecting, and distributing information efficiently.

Primary Research

The process of collecting data directly from original sources or experiments rather than using existing data.

Q77: A receiving report is a document used

Q93: Accrued wages payable<br>A)Contingent liability<br>B)Estimated liability<br>C)Known liability

Q109: Thatcher Company had a January 1,credit balance

Q126: A report explaining any differences between the

Q166: Most large thefts occur from payment of

Q168: On June 3,Zhang Co.received and recorded a

Q226: The use of the direct write-off method

Q235: Explain the options a company may use

Q238: A company had net sales of $1,540,500

Q258: The useful life of a plant asset