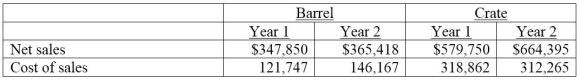

The following information is for Barrel and its competitor Crate.

Required:

1.Calculate the dollar amount of gross margin and the gross margin ratio to the nearest percent,for each company for both years.

2.Which company had the more favorable ratio for each year?

3.Which company had the more favorable change in the gross margin ratio over this 2-year period?

Definitions:

Tax Deductible

Expenses that can be subtracted from gross income to reduce taxable income, effectively lowering the overall tax liability.

Ordinary Income

Income earned from basic sources such as wages, salaries, commissions, and interest, subject to standard tax rates.

Defined Contribution Plan

A type of retirement plan where the amount contributed is specified, but the future benefit amount is not guaranteed, depending on investment returns.

Risk-free Return

Risk-free return refers to the theoretical return on investment with zero risk, representing the return on the safest assets.

Q4: A company's inventory records indicate the

Q84: How do closing entries for a merchandising

Q89: If a company mistakenly forgot to record

Q191: A merchandiser's ability to pay its short-term

Q218: The usual order for the asset subgroups

Q234: Using the following year-end information for

Q341: Reversing entries are recorded in response to

Q359: Explain how the owner of a company

Q365: A company made no adjusting entry for

Q398: The calendar year-end adjusted trial balance for