Based on the unadjusted trial balance for Highlight Styling and the adjusting information given below,prepare the adjusting journal entries for Highlight Styling.

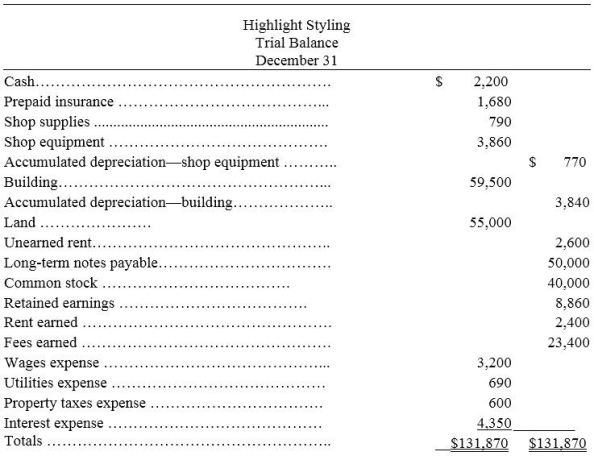

Highlight Stylings' unadjusted trial balance for the current year follows:

Additional information:

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Definitions:

Direct Method

A cash flow statement reporting approach that lists major outgoing payments and incoming receipts during a period.

Operating Activities

Activities directly related to the primary business operations of a company, including the production, distribution, and sale of goods and services.

Net Income

The total profit of a company after all revenues, expenses, taxes, and dividends have been deducted.

Dividends

Payments made by a corporation to its shareholder members, usually derived from the company's profits.

Q105: Which of the following statements is true?<br>A)

Q186: Adjusting entries made at the end of

Q197: Risk is:<br>A) Net income divided by average

Q197: Given the following errors,identify the one by

Q214: The first section of the income statement

Q234: The Financial Accounting Standards Board is the

Q276: Return on assets is useful in evaluating

Q317: Store Supplies<br>A)G<br>B)B<br>C)A<br>D)C<br>E)F<br>F)D<br>G)E

Q378: The closing process is a step in

Q434: An _ is a listing of all