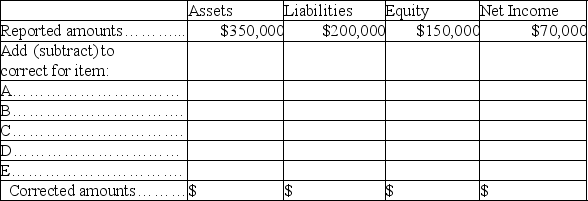

A company issued financial statements for the year ended December 31,but failed to include the following adjusting entries:

A.Accrued interest revenue earned of $1,200.

B.Depreciation expense of $4,000.

C.Portion of prepaid insurance expired (an asset)used $1,100.

D.Accrued taxes of $3,200.

E.Revenues of $5,200,originally recorded as unearned,have been earned by the end of the year.

Determine the correct amounts for the December 31 financial statements by completing the following table:

Definitions:

Interdependence of Activities

A situation in which actions or processes are mutually reliant on each other, meaning the outcome of one is affected by the execution of another.

PERT Chart

An application designed for project management to assist in planning, organizing, and managing project tasks.

Critical for Completing

Essential tasks or elements required to successfully finish a project or achieve a goal.

Critical Path Method

A project management technique that identifies the longest sequence of dependent tasks and calculates the minimum project duration.

Q28: A trial balance prepared after adjustments have

Q69: List the steps in processing transactions.

Q74: Companies experiencing seasonal variations in sales often

Q92: Drew Castle is an insurance appraiser.Shown below

Q109: Using the information presented below,prepare an income

Q160: Werner Company had $1,300 of store supplies

Q192: Objectivity means that financial information is supported

Q226: Select the account below that normally has

Q269: The cash basis of accounting recognizes revenues

Q397: Income Summary is a temporary account only