Based on the unadjusted trial balance for Highlight Styling and the adjusting information given below,prepare the adjusting journal entries for Highlight Styling.

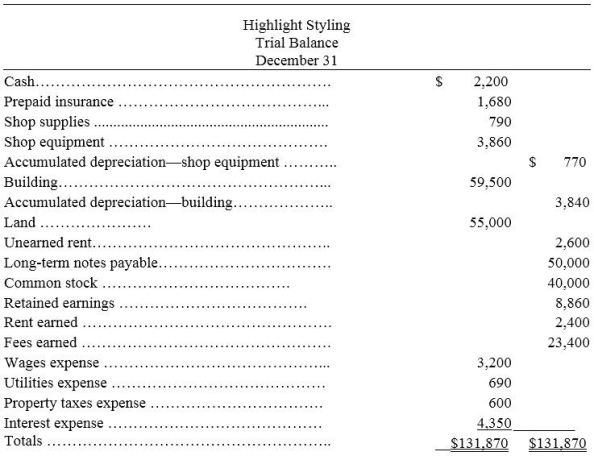

Highlight Stylings' unadjusted trial balance for the current year follows:

Additional information:

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Definitions:

Involved

Engaged or participating actively in a particular activity, process, or situation.

Perspective-taking Skills

Refers to the ability to understand and consider the thoughts, feelings, and viewpoints of others.

Mutual Perspective

A shared viewpoint or understanding between individuals or groups, often involving empathy or shared objectives.

Robert Selman

A psychologist known for his work in the development of social cognition and the theory of role-taking in children and adolescents.

Q59: An adjusting entry could be made for

Q94: Investing activities are the acquiring and disposing

Q122: Accounting is an information and measurement system

Q195: The periodic expense created by allocating the

Q201: National Storage Company had sales of $1,000,000,sales

Q203: Regulators often have legal authority over certain

Q214: A transaction that decreases a liability and

Q259: Journal<br>A)Verifiable evidence that transactions have occurred used

Q325: Investing activities are the means an organization

Q363: Using the table below,indicate the impact of