Based on the unadjusted trial balance for Glow Styling and the adjusting information given below,prepare the adjusting journal entries for Glow Styling.After completing the adjusting entries,prepare the trial balance for Glow Styling.

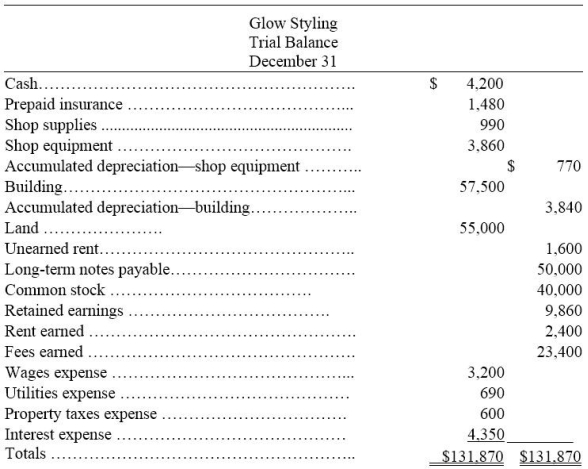

Glow Styling unadjusted trial balance for the current year follows:

Additional information:

a.An insurance policy examination showed $1,240 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,220.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was earned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Use the above information to prepare the adjusted trial balance for Glow Styling.

Definitions:

Traditional Model

A conventional approach or method in a specific field that has been widely accepted and used over time.

Social and Political Activism

The act of advocating for, supporting, or participating in efforts and movements aimed at political, economic, or social change.

Client Advocacy

The act of supporting and promoting the interests and rights of clients, especially in healthcare, social services, and legal settings, to ensure they receive appropriate care and services.

Preventive Education

Educational programs aimed at teaching individuals skills and knowledge to prevent, recognize, and respond to potential problems or risks before they occur.

Q87: Revenues and expenses are two categories of

Q111: Assuming prepaid expenses are originally recorded in

Q126: Double-entry accounting<br>A)Verifiable evidence that transactions have occurred

Q200: Determine the net income of a

Q270: Every business transaction leaves the accounting equation

Q281: An external transaction is an exchange within

Q331: Net income for a period will be

Q361: The _ depreciation method allocates equal amounts

Q397: Income Summary is a temporary account only

Q427: The cash basis of accounting is a