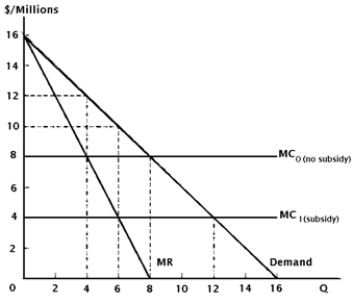

Assume Boeing Inc. (of the United States) and Airbus Industries (of Europe) rival for monopoly profits in the Canadian aircraft market. Suppose the two firms face identical cost and demand conditions, as seen in Figure 6.1.

Figure 6.1. Strategic Trade Policy: Boeing versus Airbus

-Referring to Figure 6.1, assume that Boeing is the first to enter the Canadian market.Without a governmental subsidy, the firm maximizes profits by selling ______________ aircraft at a price of $______________, and realizes profits totaling $______________.

Definitions:

Litigation File

A collection or compilation of all documents, evidence, correspondences, and records pertinent to a legal case.

Correspondences

Written communication or exchange of letters between individuals or organizations.

Legal Fees

Charges for legal services provided by a lawyer, including consultation, representation, and documentation.

Initial Client Interview

The first meeting between a lawyer and a client where the lawyer gathers information about the client's case, explains the legal process, and determines the legal strategy.

Q14: Europe's jumbo-jet manufacturer,Airbus,has justified receiving governmental subsidies

Q20: The official reserve assets of the United

Q53: International joint ventures tend to yield a

Q56: On the balance-of-payments statement,a capital inflow can

Q67: Consider Figure 8.2.With free trade Portugal will<br>A)

Q78: A specific tariff is expressed as a

Q79: Legislation requiring domestic manufacturers to install pollution

Q92: The deadweight losses of an import tariff

Q106: The implicit industrial policies of the U.S.government

Q125: Consider Figure 5.3.Assume that Swedish import companies