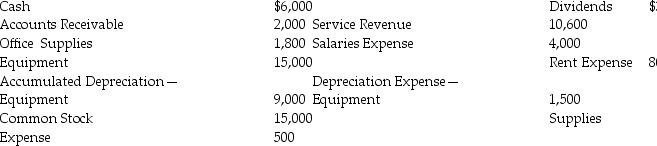

Deborah Consultants had the following balances before preparing adjusting entries in the books on December 31,2015.

Prepare the adjusted trial balance after considering these adjustments:

Prepare the adjusted trial balance after considering these adjustments:

a.Office Supplies used,$800.Assume the office supplies were initially recorded as an asset.

b.Accrued salaries on December 31,$600.

c.Revenue accrued but not recorded,$200.

Definitions:

Postretirement Benefit Expense

The cost recognized by companies related to the various benefits provided to employees after retirement.

Funded Postretirement Benefit Plans

Retirement plans for which assets have been set aside in advance to pay future benefits owed to employees, securing the promised benefits.

Benefit Expense

The costs incurred by a company for the health benefits, retirement benefits, and other perks offered to employees.

Postretirement Benefit Plans

Plans offered by employers that provide benefits, such as health insurance and pensions, to employees after they retire.

Q13: Which of the following accounts would appear

Q40: On September 1,2014,Joy Inc.paid $8,000 in advance

Q43: VB Specialty Foods,a grocery merchandiser,purchased goods and

Q47: For Revenues,the category of account and its

Q50: Evans Inc.had the following balances and transactions

Q93: The Common Stock account is a temporary

Q102: James Inc.earned revenue of $500,000 and incurred

Q103: The ending merchandise inventory for the current

Q147: Under which of the following inventory costing

Q149: Beetles Inc.recorded the following journal entry