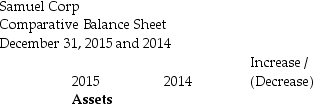

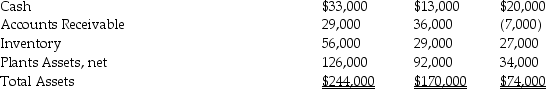

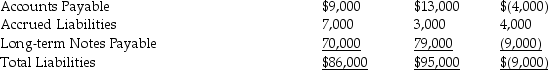

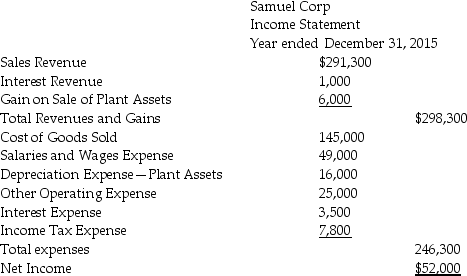

Samuel Corp.has provided the following information for the year ended December 31,2015.

Current Assets:

Current Assets:

Additional information provided by the company includes the following:

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net asset value of $10,000 was sold for $16,000.

Depreciation Expense of $16,000 was recorded during the year.

During 2014,the company repaid $43,000 of Long-Term Notes Payable.

During 2014,the company borrowed $34,000 on a new Long-Term Note Payable

There were no stock retirements during the year.

There were no sales of treasury stock during the year.

All sales are on credit.

Prepare a complete statement of cash flows using the indirect method.

Definitions:

Subjective Evaluations

Assessments based on personal feelings, tastes, or opinions rather than external facts or criteria.

Sense of Self

An individual's perception of their unique identity and personality, developed over time.

Older Parents

Individuals who become parents at an age that is considered older than is typical for childbearing, often involving unique challenges and perspectives.

Raised

Brought up or nurtured growth in a specific environment or manner.

Q7: A common-size statement reports only percentages that

Q14: The Amazing Widget Company issues $500,000 of

Q21: Tryst Inc.has a policy of accruing $1,500

Q40: The interest rate on which cash payments

Q46: At the beginning of 2015,Swift Inc.Work-in-Process Inventory

Q132: Goods that are produced by a manufacturing

Q138: Gordon Corporation reported the following equity section

Q166: Fireox Inc.selected cost data for 2015 are

Q171: Fireox Inc.selected cost data for 2015 are

Q175: Comparing actual performance to previously budgeted amounts